So many people ask us, can someone attach liens or judgements to my retirement savings. The long and short answer is, only if you let them.

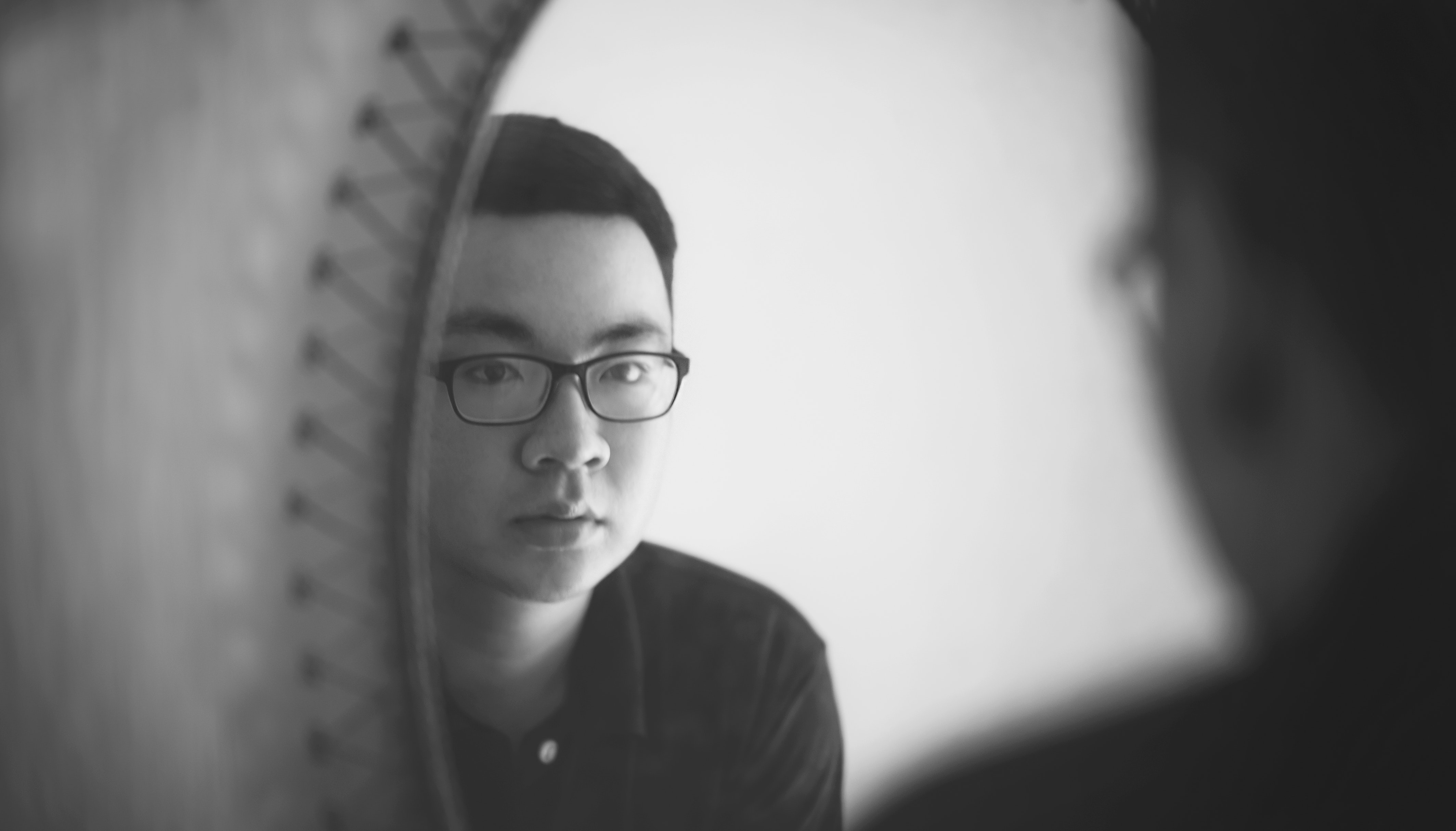

Federal bankruptcy laws protect your retirement savings held in legally recognized retirement accounts from judgements and liens. However, your retirement savings are at risk from one particular liability; go ahead and look in the mirror and know that you’re staring at the single biggest threat to your retirement savings, YOU.

You and only you can withdraw money from a retirement account or take out loans against things like a 401(k). Your creditors know this and would be thrilled to convince you to do this in order to get out of a financial mess. However, let me be frank, this is an absolutely horrible, no good, very bad idea.

The Modus Operandi of debt collectors

Collecting a debt via the courts is time consuming and costly. It requires lawsuits (which require lawyers), filing fees, and the chance that the person being sued will fight back, making the matter even more expensive.

Lawsuits require lawyers, filing fees, and a chance for the person sued to fight back. And even with a judgment, exemptions protect some assets from lien or levy by the creditor with a judgment.

If you’re a creditor, it’s so much better (and cheaper) to convince you to dip into that fat little retirement account you have VOLUNTARILY (read:the one they can’t get to without you) and pay them what they want. They’ll do this through a mix of the following:

- Annoyance: they’ll call you and send you letters incessantly

- Shame: they’ll try to tell you what a deadbeat you are and convince you you’re a bad person for not paying them or

- Fear: they’ll try to scare you into thinking that they can ruin your life and take everything you have (they can’t).

Whatever they do, they’ll try to pressure you and mess with you until you screw up and take money from your own retirement to pay off a debt that you can get rid of through other means.

The Bottom Line is, your retirement savings is never the right answer

Some people feel like they have no other choice but to raid your retirement savings but I tell those people to ask themselves these simple questions:

- How much longer am I going to work and is that enough time to replenish my savings?

- Is there a plan funded by my employer (pension) that I can rely on?

- Do I have any other assets that can supplement my retirement?

- Is this bill I’m raiding my retirement savings to pay part of a bigger problem on my part?

In all honesty, the last question is the biggest question you should be asking yourself. Is raiding my retirement savings a one time solution, or is it the first, or the most recent, indicator that your finances are out of control and you’re unable to pay your bills.

If the latter is true, it’s time to talk to a bankruptcy attorney, now. . Understand what your options are. Look at the big picture that includes all of your debts and all of your assets. You can probably find a better solution.