Everyone has an emergency pop up from time to time. The car needs repairs, you broke your arm, the toilet is backing up or the roof is leaking. An unexpected emergency can cause a serious problem for lots of people. We have talked about the savings rate in America before and how so many people have so little money saved for retirement or unexpected expenses. A new study recently released by bankrate.com paints a very bleak picture for people in the United States when it comes to funding an emergency. We you can read the study in the post above or we can give you the TL;DR summary here:

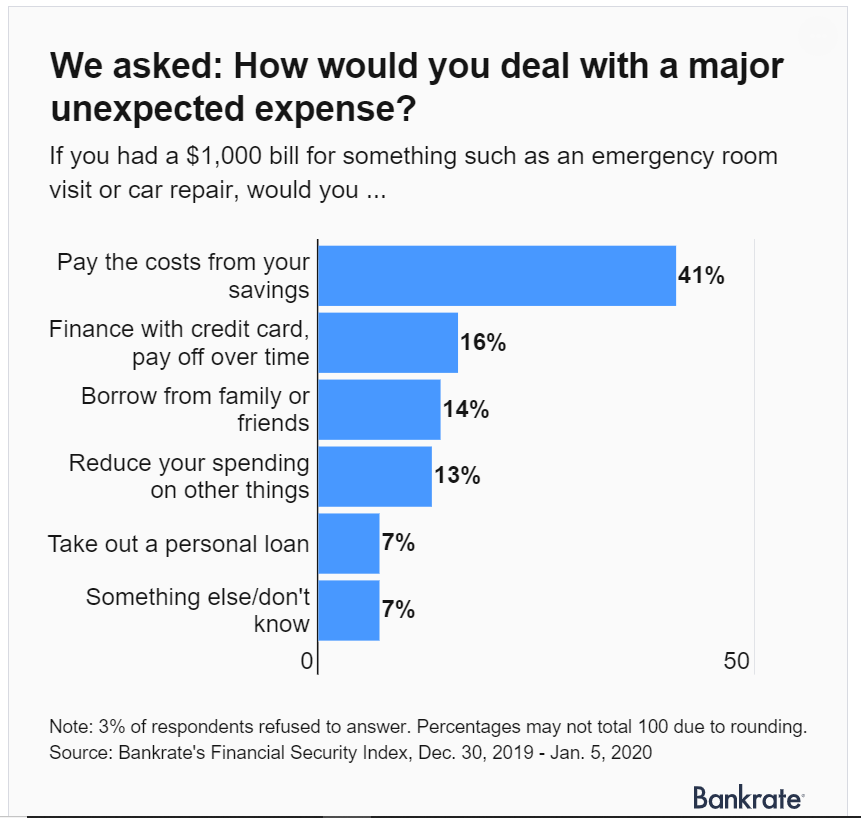

- Bankrate reports indicate that the percentage of U.S. adults who would use their savings to cover a $1,000 emergency room visit or car repair has remained within the range of 37 to 41 percent since 2014.

- Nearly four in 10 Americans (37 percent) would borrow money in some capacity if hit with an unexpected bill.

- Among respondents who reported that they or a close relative paid for a major unanticipated expense in the past year (28 percent), the average cost was $3,518.

Having an emergency can be expensive. The average cost of an unexpected emergency expense is over $3,500. That can put a pinch on the wallet of even the best savers in our country, yours truly included. Over 30% of the respondents to the survey said that they would have to take on additional debt to cover the expense of a $1,000 emergency. Many people even turn to fundraising services like Go Fund Me to help with unexpected problems. While all of these are options in a time of need, what we really need to look at is the cause of the problem, our ability to save. So many people are burdened with debt and debt collectors live to make money off the shame of having debt. Funding unsustainable debt keeps up from being able to get our lives back on track and increase our savings.

That’s where we step in. Bankruptcy is viewed by many as a last resort. Something that is shameful or should only be considered if you’ve exhausted all options. The truth is, Bankruptcy is a good financial tool that can help you get your life in order and get a fresh financial start. Harmon and Gorove offers Chapter 7 and Chapter 13 bankruptcy plans to help you get your life back in order and hit the reset button on your finances. Contact the attorneys at Harmon and Gorove today for a free consultation. Let us help you sort out your life so the next time a $1,000 emergency comes along, you’re prepared.