3 uses for your Stimulus Check

As of the writing of this blog entry, more than 22 million Americans have filed for unemployment and millions more are staring into the abyss. COVID-19 has decimated what was one of the strongest economies in American history. Businesses are closing and some of the most famous names in retail are likely to be seeking bankruptcy protection in the very near future. There is one silver lining in all this and that’s the help we’re all getting from the government in the form of Stimulus checks to help offset the damage COVID-19 has done to people’s ability to function financially. A lot of people don’t often receive a big lump sum payment like this and many are asking, what should I do with my newfound windfall. We have a list below to help you decide.

Meet your basic needs

Everyone has ongoing expenses that they must pay for, your stimulus can help.

Food: You’ve got to eat and so does your family. You’ve got to be able to put food on the table day in and day out. If you don’t have any other means of putting food on the table, this check can seriously help with one of life’s greatest necessities.

Housing: You’ve got to keep a roof over your head. Many people are finding offers of forbearance on loans and rent, but be sure to read the fine print. Many banks and landlords are offering forbearance but the devil is in the details. Many of those banks and landlords will expect the entire amount due at the end of the forbearance period. If you can, pay your mortgage or your rent.

Transportation: If you’re lucky enough to have a job now or one to go back to once everything goes back to normal, you need to keep a set of wheels.

Utilities: You should pay your bills if you can. While many utility companies are’t disconnecting during the crisis, don’t think that’s going to be a free ride. The tab is still running and they will eventually expect payment, possibly with interest and fees. The bottom line is, look on their websites for coronavirus accommodations and how to contact them for assistance. Don’t ignore bills. Stay in touch with each company if financial hardship puts you behind and you can’t pay.

Save it

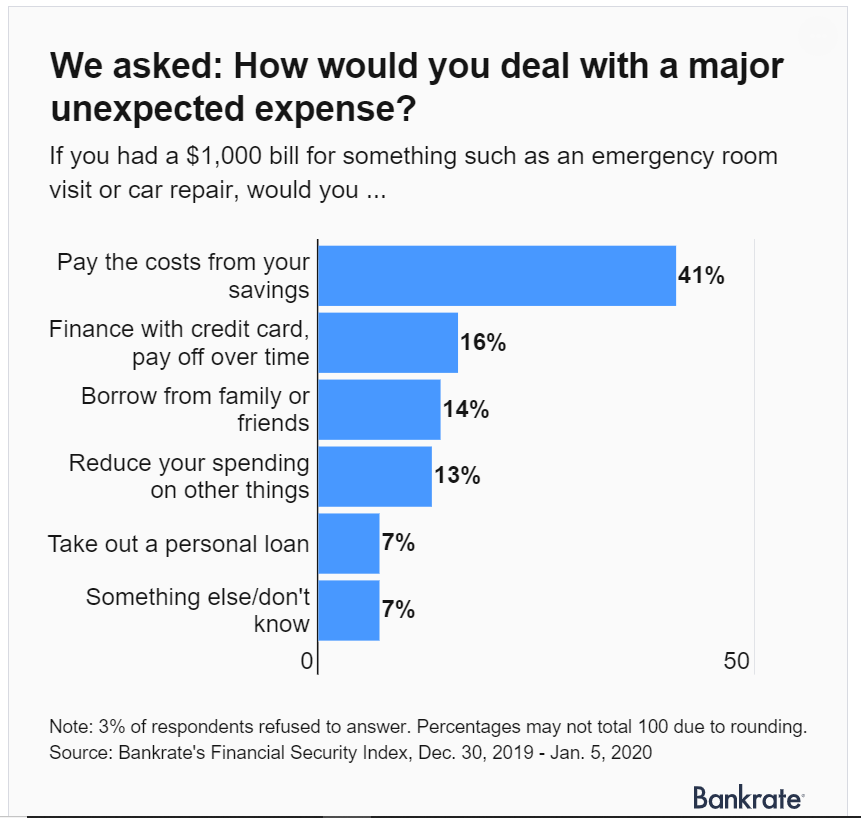

We have written before about the number of Americans who don’t have even enough money in their bank account to cover a $1,000 emergency. With each person getting $1,200 in stimulus money and families getting more, if you are one of the fortunate people who still have a job, use this money to help build up a fund to cover the unexpected burdens you may not see coming yet.

Invest in your future

Eventually, everything will get back to normal and when it does, you’re going to have a lot of financial decisions to make. If you aren’t in the position to save your money and you’ve stopped paying some of your bills like credit cards and personal loans, know that your creditors will eventually come looking for you and the money you owe them. If you already had a good amount of debt to begin with maybe you’re realizing that now may be a good time to start fresh with a clean slate. At Harmon and Gorove, that’s what we’ve done for nearly 40 years. If you’re facing financial uncertainty because of unsustainable debt, contact the attorneys at Harmon and Gorove for a free consultation to discuss how bankruptcy can put you on the path to financial security.