Debts that follow you

Some debts just follow you out of bankruptcy.

There aren’t many but some do exist.

Debts on the list below can, and often are, collectible after your discharge in a Chapter 7. Chapter 13s however, are often better vehicles for ridding yourself of many of these debts.

Family/Domestic support payments

It doesn’t matter what your state calls it, these types of payments, made to former spouses or children, are not dischargeable.

Your most recent taxes

Income taxes are not dischargeable if they are less than three years old.

Taxes that can still be assessed

If you file bankruptcy in the middle of the year, it doesn’t quash the ability of taxing authorities to continue to collect taxes for that year.

Unfiled taxes

It doesn’t matter if the tax debt is 12 years old, if you didn’t file a tax return, the clock hasn’t started ticking yet.

Payroll taxes

Your employer withheld taxes for things like medicare and social security are not dischargeable.

Judgments for drunk driving

Liability for death or personal injury from impaired operation of a vehicle

Debts from divorce

If you owe money to your former spouse and/or your children because of a divorce, you may not have that debt discharged.

Student loans

Student loans are almost never dischargeable….seriously. Anyone who tells you otherwise, is lying.

Loans you took to payoff taxes

You can’t pay your taxes with a loan you wish to file against.

Government Fines

If you are being punished by a government for a criminal act, you may not discharge that debt.

Non dischargeable if….

There are three additional times where a debt can survive a bankruptcy, but it requires some fancy legal maneuvering by a creditor’s attorney.

Any debt you incurred through fraud, breach of fiduciary duty or deliberate injury to someone’s person or property. Each of these debts require a victim to file suit or charges against someone to prove it actually happened.

There are also actions where a creditor can object to the dischargeability of the debt based on evidence that you created that debt through bad faith or bad behavior. The presumption favors the debtor, but if the creditor can establish that the debt was created by your bad faith, the law has a duty to see that those debts are not dischargeable.

You do have to understand that the debt actually has to be incurred because of your bad behavior. Not paying a debt is not bad behavior, you actually have to do something bad.

Some liens survive…

Bankruptcy wipes out your personal liability for a debt, but if a lien exists before the bankruptcy is filed, that lien can survive the bankruptcy but you can’t be held liable for the debt. In other words, If your car is repossessed and the bank sells it for less than you owe, they can no longer sue you for the difference. Same thing with your house. If you don’t reaffirm your mortgage, but you keep making payments, the bank will be happy to take your money. However, if you quit making the payments and the house is foreclosed upon, the bank can’t sue you if they sell it at a loss.

After your bankruptcy, if you continue to make your payments on the secured debts, creditors are happy to get your money and leave you alone. If for some reason you change your mind or if more financial trouble is coming down the pipe for you, you are allowed to walk away from the liened property and only lose the property.

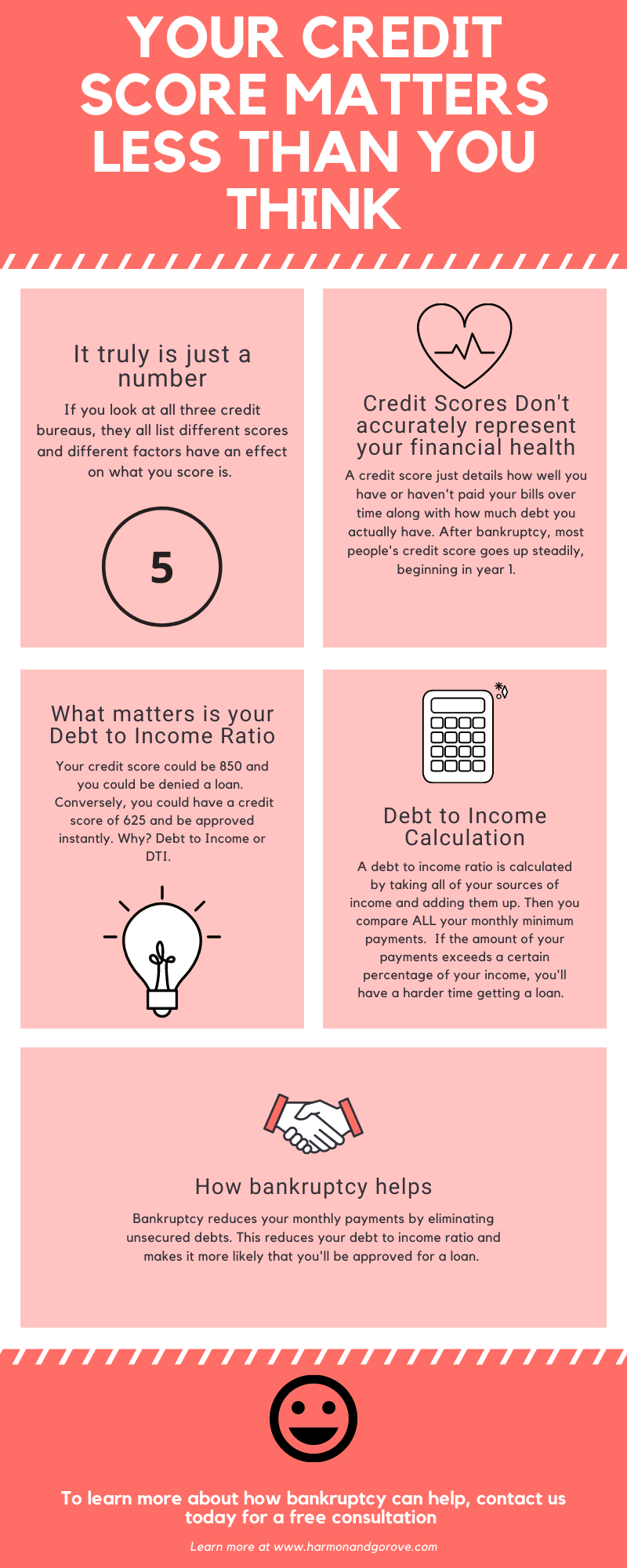

The attorneys at Harmon and Gorove can walk you through the process and tell you about your options. Call us today to set up a free, no obligation consultation with one of our award winning attorneys do discuss your situation.