Our clients are often so very concerned about their credit score. That’s natural, and frankly, we are too. I check my credit score at least once every two weeks. It’s a point of pride for many people. For others however, it can be the difference in being able to get ahead in life or not being able to afford those things we need.

We have some very good news to report for people who are worried about the impact that bankruptcy will have on their credit score. The good news is, and I say it boldly;

AFTER BANKRUPTCY, CREDIT SCORES GO STEADILY UP

That’s right. All these years you’ve been lied to by people who have no idea what they’re talking about. Telling you that if you file bankruptcy your finances are toast and you’re dead in the water. You’ll never get another loan again. We’ve all heard it and it’s usually coming from the slime ball that charged you 97% interest on a $2,500 car loan.

We didn’t just make this up either, although we already knew this to be true, this is a report from the Consumer Financial Protection Bureau. The study, which you can read here is completely legitimate and has been researched over the last 17 years. Another finding from the study is

A PERSON’S CREDIT SCORES START IMPROVING THE SAME YEAR AS YOUR BANKRUPTCY FILING

Take a minute and absorb that.

How Creditors Use Fear

Creditors and all their hack buddies scream from the rooftops about bankruptcy trashing your credit score. The data shows just the opposite. In fact, there’s usually no dip in your score after filing. The overwhelming amount of people who file bankruptcy see an IMMEDIATE increase in their score. Don’t believe us, just read what the CFPB says:

Median credit scores increase steadily from year-to-year after consumers file a bankruptcy petition.

Median scores for Chapter 7 filers recover more quickly than those for Chapter 13 filers possibly due to the much quicker and more likely discharge of Chapter 7 filings.

Bankruptcy improves your Financial Health

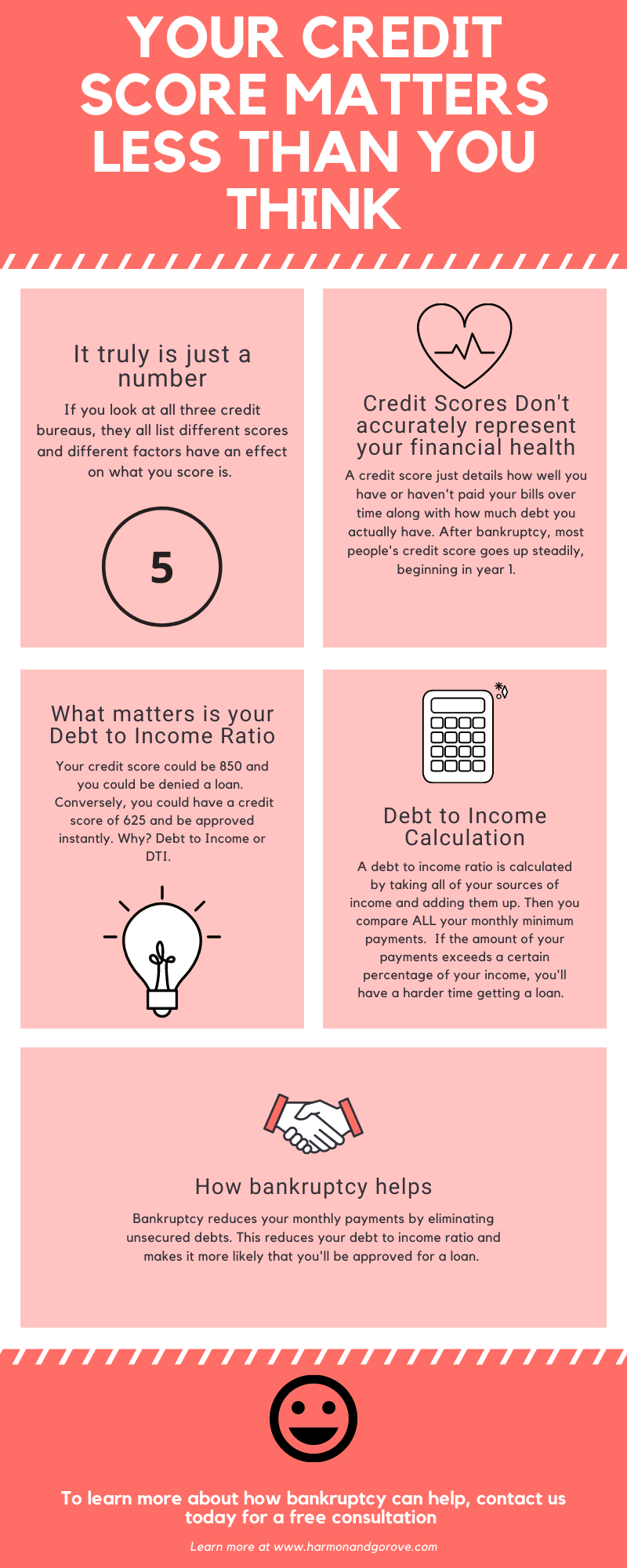

When it comes to your financial health, let’s get one thing straight. Your credit score is a vastly inadequate indicator of your financial health. What really matters is your balance sheet.

A credit score is a distraction

In the grand scheme of loans and credit, lenders look at your balance sheet as much or more than your credit score. In essence, they look at your net worth which is comprised of assets minus liabilities. If you eliminate the liabilities you have via bankruptcy, your net worth looks even better.

A credit score is just a number, most banks prefer a measure called the Debt to Income ratio or DTI. If you wipe out unsecured debts, your DTI goes down as well, improving your likelihood of getting approved for a loan.

Boost your credit score

You can take actions that can boost your score. One of the best ways to do that is to check your credit report. Not just your score, but what’s listed on your report. When you look into credit reports, you’ll find that credit reports are notoriously inaccurate. Nearly 1 in 4 credit reports had factual inaccuracies that could negatively impact your credit score. That’s why its very important to check your credit report often, even more so than your score itself.

Is bankruptcy right for me?

Just because you can file bankruptcy, doesn’t mean you should. It’s just one of the things you should consider if you find yourself needing to file. Lots of different factors influence whether you should file bankruptcy. We discuss those factors in one of our recent blog posts

If you’re ready to discuss filing bankruptcy with an experienced bankruptcy attorney, contact our office today for a free, no obligation consultation.