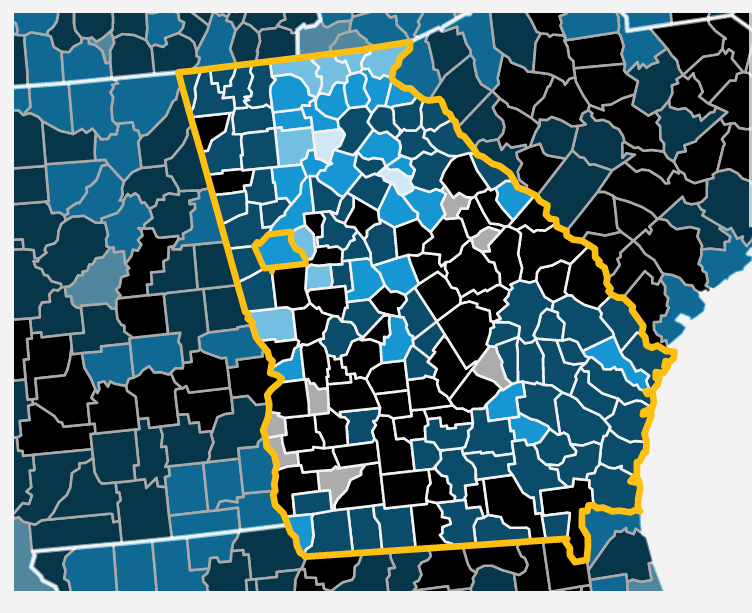

Consumer debt all over the country is approaching record levels. We are all aware of the student loan crisis and medical debt, but the reality is, debt of all kids is at an all time high. Citizens of the State of Georgia are facing incredible levels of debt. More than 39% of Georgia residents have at least 1 account currently tied up in debt collection. A recent CNN report states that more than $14 Trillion dollars of debt is outstanding in America. That includes mortgages, student loans, car loans and credit cards, medical debt and other debts. These levels of debt are scary to most people because levels of debt this high represent unsustainable amounts of money to service these debts.

The average American Family lives on less than $64,000 per year and while that number has risen lately, it pales in comparison to the average amount of debt carried by Americans at more than $137,000 . Citizens of Georgia face higher collections and levels of debt that the national average. Citizens of Georgia have on average about $2,700 of credit card debt which on average costs around $275 a month in payments in order to actually pay it off. That is a significant payment for most citizens in Georgia who average a gross monthly income of only $4,600 before taxes.

What can we do about debt? Well that’s the million dollar question. We try to pay it off if we can. No one takes out a loan wanting to not pay it. We often find ourselves struggling to deal with paying our debts and maintaining basic necessities and unexpected emergencies. If your level of debt has become unsustainable, contact the attorneys at Harmon and Gorove to see how we can help you achieve freedom from debt with a completely free consultation with one of our award winning attorneys.