Garnishment Survival Guide

“Your wages are subject to garnishment,”

That’s the first line in your most recent letter from HR.

If You Do nothing 25% percent of your net earnings will be sent to whatever creditor has a judgement against you.

Do something: keep reading this if you live in Georgia and are subject to a wage garnishment.

I have three points to make here:

- What to do in the short term,

- What to do in the medium term, and

- in the long run, what can we do to keep this from happening again.

What is Wage garnishment

A wage garnishment is an order from a judge, obtained after a judgement is secured against you, that allows a creditor to take money directly out of your check to satisfy the judgement they obtained.

The fact that you are getting garnished means that a judgement has already been obtained by a creditor and a judge has agreed that you are liable for an amount of money you owe to the creditor. If everything happened the way it was supposed to, you should have gotten a copy of the complaint that was filed against you. Due process requires that before the hearing to determine whether and how much you owe, you’re served with the complaint and have a chance to defend yourself against the complaint in court. That doesn’t always happen like it’s supposed to and we’ll discuss that later.

Georgia allows creditors, once they have a judgement, to take your wages directly from the source, your job, to collect on a judgement. Your wages are protected to an extent by state and federal laws. The cap is currently 25%.

In this article we are going to look at the judgments you’re most likely to face. Judgments for unpaid medical bills and credit cards. There are a number of other judgments that we won’t worry about today.

1. Protect Your Paycheck

The garnishment allows the creditor to take 25% of your paycheck, but that’s the max and that’s after other deductions are subtracted.

There are a number of other exemptions under Georgia Law and you need to review them to find out if any of them apply to your situation. If you don’t fall under those exemptions there isn’t much you can do to stop a garnishment outside of bankruptcy.

Notify your payroll department of your exemptions

If you pay falls under the scope of the exemption you need to make sure that your payroll is aware of it. Theoretically, they should be aware of it as it is their job to follow the law, however, it’s always best to remind them of their duties and that you believe your income to be exempt from the garnishment.

2. Attack The Judgment

Your wages can only be garnished if a court has determined that you actually owe the money your creditor says you owe. If you were at the hearing and lost, it is your job to appeal. If you didn’t appeal, the matter is close and the judgement stands..

However, If the judgement was a complete surprise to you (in other words, you weren’t properly served) you may have a chance to fight back. This is a procedural attack on the judgement not one attacking the merit of the creditor’s claim. Attacking claims are hard though and will usually require the assistance of an attorney. There are some legal aid societies that may be willing to help, but if you don’t qualify you’re on your own to either figure it out or hire an attorney. This is only a good thing to do if procedure truly wasn’t followed AND you have a good defense. You don’t want to go to the trouble and potential expense of fighting the claim if you’re just going to lose anyways.

3. Completely examine your finances.

Your time is precious and limited. Before you try to really hunker down and try to fight this, you need to take a look at your entire financial picture. You need to ask yourself a question and it’s very important for you to reflect on it:

“If I handle this debt, will I still be able to pay all my other debts?”

If the answer is yes, there are a number of reputable credit counselors and social workers who can help people develop budgets. Some organizations like the Salvation Army help people create budgets that, if adhered to, can help people to live within their means.

If the answer is no, you need to look at other options, primarily bankruptcy. There are tons of debt settlement companies out there and most of them are either outright scams or they don’t offer real, lasting solutions to your problems.

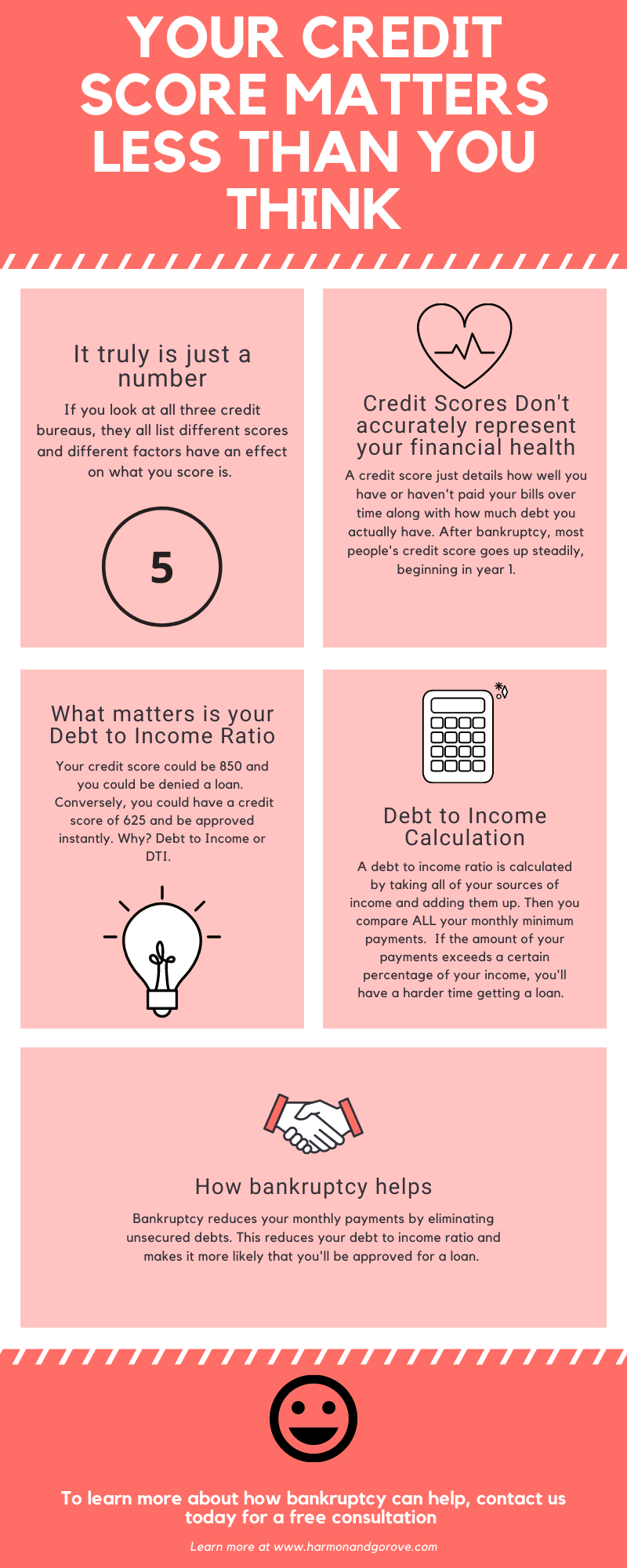

Bankruptcy attorneys are well versed in analyzing finances and determining whether or not you are able to get out of your financial troubles without the help of Bankruptcy.

If you’re facing a garnishment, reach out to the attorneys at Harmon and Gorove. They offer a free, no obligation consultation to help you decide your best course of action.