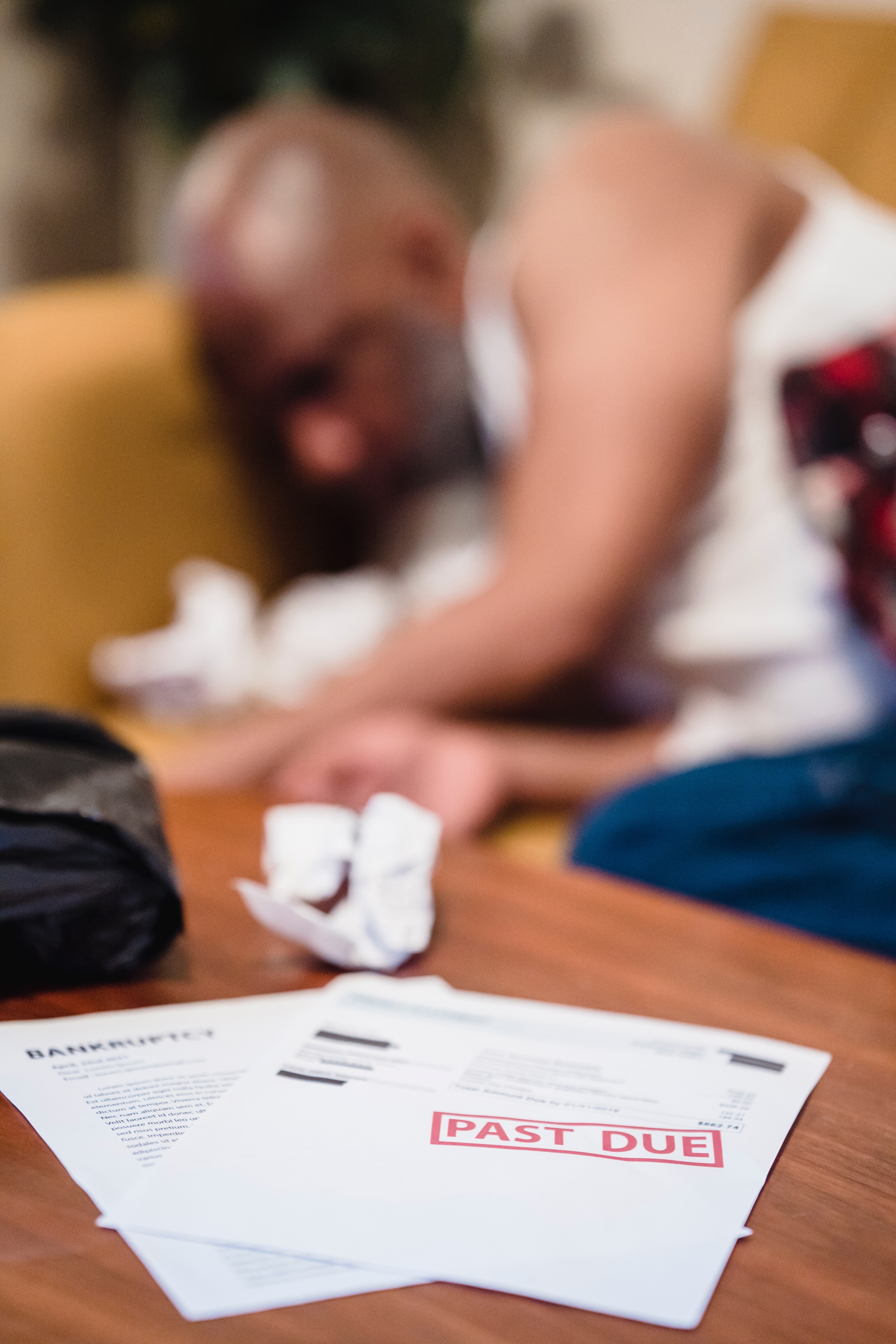

70% of American are feeling Financial Stress. Chapter 7 or 13 Bankruptcy can help.

According to a new CNBC survey, 70% of Americans are feeling financially stressed. This is not surprising given the economic challenges that many people have been facing in recent years. However, there are ways to address financial stress, and one of those ways is through bankruptcy.

Bankruptcy is often seen as a last resort for people who are struggling with debt. However, it can actually be a powerful tool for reducing financial stress and starting fresh. Bankruptcy can help people in several ways:

-

It can stop creditor harassment: When people fall behind on their bills, they often receive calls and letters from creditors demanding payment. This can be a source of constant stress and anxiety. Filing for bankruptcy can put an end to this harassment, as creditors are required to stop contacting debtors once they file.

-

It can eliminate unsecured debt: Bankruptcy can discharge many types of unsecured debt, such as credit card debt, medical bills, and personal loans. This means that people can get a fresh start without having to worry about these debts hanging over their heads.

-

It can prevent foreclosure or repossession: If people are behind on their mortgage or car payments, they may be at risk of losing their homes or vehicles. Filing for bankruptcy can stop the foreclosure or repossession process and give people time to catch up on their payments.

-

It can create a payment plan: Chapter 13 bankruptcy allows people to create a repayment plan for their debts. This can make it easier for people to manage their debts and can reduce financial stress.

Overall, bankruptcy can be a powerful tool for reducing financial stress and starting fresh. While it is not the right choice for everyone, it is important to consider all options when dealing with financial difficulties. If people are feeling overwhelmed by their debts, they may want to speak with a bankruptcy attorney to learn more about their options.